Article

Top 3 Questions Leaders Should Consider When Selling Their Credit Card Portfolio

Elan recently hosted a webinar with industry expert, Tim Kolk, President of TRK Advisors about diving into the agent credit card model and how it impacts credit unions and their members.

When determining if outsourcing their credit card program is the right solution for them, Tim encouraged leaders to consider these three questions:

1. Can your credit union compete with other issuers?

Being a successful issuer today requires never-ending technology investment, data analysis proficiency, product management expertise, marketing acumen, cardholder servicing excellence across multiple channels, and a willingness to meet consistent calls for financial and other resources.

Is your credit union set up to compete with the offerings of other issuers?

2. Has your credit union been growing at least at market rate?

As discussed during our 2024 Credit Card Market Webinar, there is increasing market pressure.

From 2007 through 2018, credit union card portfolios grew at a faster rate than bank portfolios in 12 of those 13 years (excluding Navy FCU). However, in 2023, 86% of credit unions underperformed market growth rates — i.e., they fell behind competitively.

Request an analysis of your credit card portfolio through the form below.

3. Is your credit union prepared for the risks of the next economic cycle?

The move to risk-based capital has placed credit card balances in the highest-burden category, where banks have long recorded credit card balances. When deciding on how best to use capital, credit unions must take this dynamic into account.

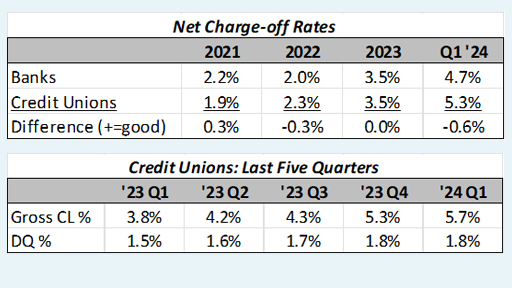

Losses have been escalating for credit card issuers across credit unions and banks alike. Overall charge-off rates increased from 2.0% in 2022 to 3.5% in 2023 and now to 4.7% in the first half of 2024. However, while credit unions have also traditionally had lower charge-off rates than banks by hundreds of basis points, that is currently not the case.

If you missed the event, or want to learn more, you may watch the recording and download the full presentation here.

In addition, Tim Kolk wrote an interesting article on why credit unions are selling their credit card portfolios: https://creditunions.com/blogs/industry-insights/6-reasons-credit-unions-are-selling-their-credit-card-portfolios/

Start a conversation

If you are interested in learning how Elan can help your credit union grow, we'd love to hear from you.